© Government Window, LLC.

All Rights Reserved.

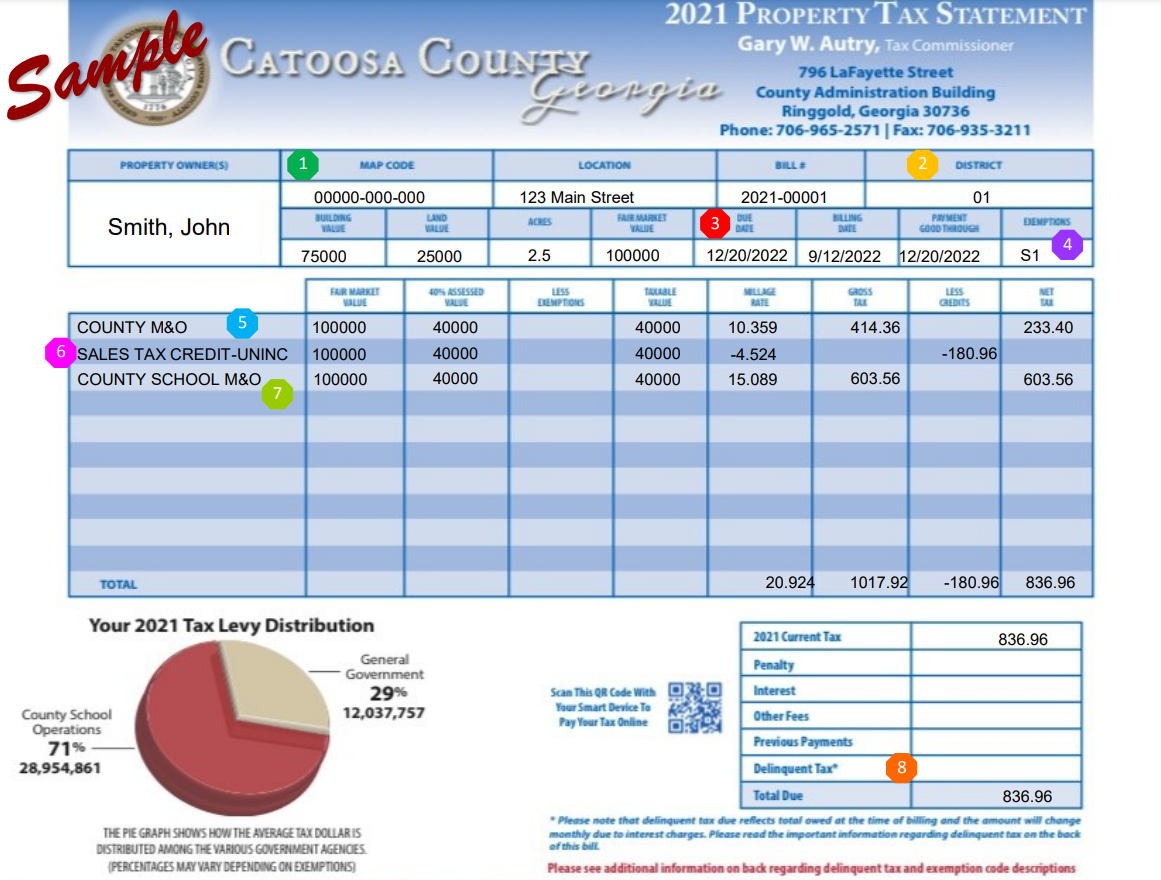

Generally, Catoosa County property taxes are due by December 20. If taxes are not paid on the property, it may be levied upon and ultimately sold. Taxes for the City of Ringgold and City of Ft. Oglethorpe are included on the county tax bill.

Map Code The property/parcel identification number assigned to a property for tax and valuation purposes by the Tax Assessor’s Office.

These numbers are actually a short legal description and are specific to the property to which it is assigned.

Map Code The property/parcel identification number assigned to a property for tax and valuation purposes by the Tax Assessor’s Office.

These numbers are actually a short legal description and are specific to the property to which it is assigned.  District The section of the county in which you live for taxing purposes (District 01—County, District 02—City of Ringgold, District 03—City of Fort Oglethorpe). Local ordinances dictate applicable fees and millage rates within the districts. Voting districts do not mirror the taxing district you are in.

District The section of the county in which you live for taxing purposes (District 01—County, District 02—City of Ringgold, District 03—City of Fort Oglethorpe). Local ordinances dictate applicable fees and millage rates within the districts. Voting districts do not mirror the taxing district you are in. Due Date The last date that payment of tax bills can be made without the possibility of interest or penalty being applied.

Due Date The last date that payment of tax bills can be made without the possibility of interest or penalty being applied. Exemptions Relief from a certain amount or portion of tax liability granted to a property owner upon approval of an application.

Exemption amount is reflected in the “less exemptions” column of the bill.

Exemptions Relief from a certain amount or portion of tax liability granted to a property owner upon approval of an application.

Exemption amount is reflected in the “less exemptions” column of the bill.  County Maintenance and Operation Portion of the county mill rate used to pay for the operations of the County’s General Fund. Administration, Finance, Judicial, Public Works, Recreation, Public Safety and Law Enforcement functions are funded by these collections.

County Maintenance and Operation Portion of the county mill rate used to pay for the operations of the County’s General Fund. Administration, Finance, Judicial, Public Works, Recreation, Public Safety and Law Enforcement functions are funded by these collections.  Sales Tax Credit Taxpayer savings based on prior year Local Option Sales Tax proceeds.

Sales Tax Credit Taxpayer savings based on prior year Local Option Sales Tax proceeds.  School Maintenance and Operation A portion of the tax bill’s mill rate dedicated to School System General Fund expenditures, operations, maintenance, and repairs of school buildings and for salaries, wages, and benefits for teachers and administrative staff, etc.

School Maintenance and Operation A portion of the tax bill’s mill rate dedicated to School System General Fund expenditures, operations, maintenance, and repairs of school buildings and for salaries, wages, and benefits for teachers and administrative staff, etc.  Delinquent AmountThe amount of unpaid taxes and fees outstanding from previous years (if applicable) and were subject to interest and penalty.

Delinquent AmountThe amount of unpaid taxes and fees outstanding from previous years (if applicable) and were subject to interest and penalty.